us germany tax treaty withholding rates

See Article 10 10 of the United States- Germany Income Tax Treaty. Taxes for Expats The US Germany Tax Treaty BrightTax.

Withholding Tax Rates To Non Residents Download Table

This table lists the income tax and withholding rates on income other than for personal service income including rates for interest dividends royalties pensions and annuities and social security payments.

. Germany - Tax Treaty Documents. The United States will treat this reduction as a partial imputation. Tax resident is entitled to the listed rate of tax from a foreign treaty country although generally the treaty rates of tax are the same.

Information is provided as a courtesy and is not guaranteed to be up to date. 30 10 30 Note there are certain exemptions that may apply. The complete texts of the following tax treaty documents are available in Adobe PDF format.

You claim a reduced rate of withholding tax under a treaty on interest dividends rent royalties or other fixed or determinable annual or periodic income ordinarily subject to the 30 rate. Withholding tax and capital gains tax. This page contains information on tax withholding rates for countries with tax treaties with the US.

Article 11 of the United States- Germany Income Tax Treaty deals with the taxation interest. Withholding agents are permitted to withhold at a lower rate if the beneficial owner properly certifies their eligibility. Global tax rates 2022 is part of the suite of international tax resources provided by the Deloitte International.

In this case the treaty provides that the tax will be levied at a maximum 5 tax rate of the gross amount of the dividends if the recipient owns at least 10 of the voting power in the company paying the dividends. For further information on tax treaties refer also to the Treasury Departments Tax Treaty Documents page. The treaty has two main goals.

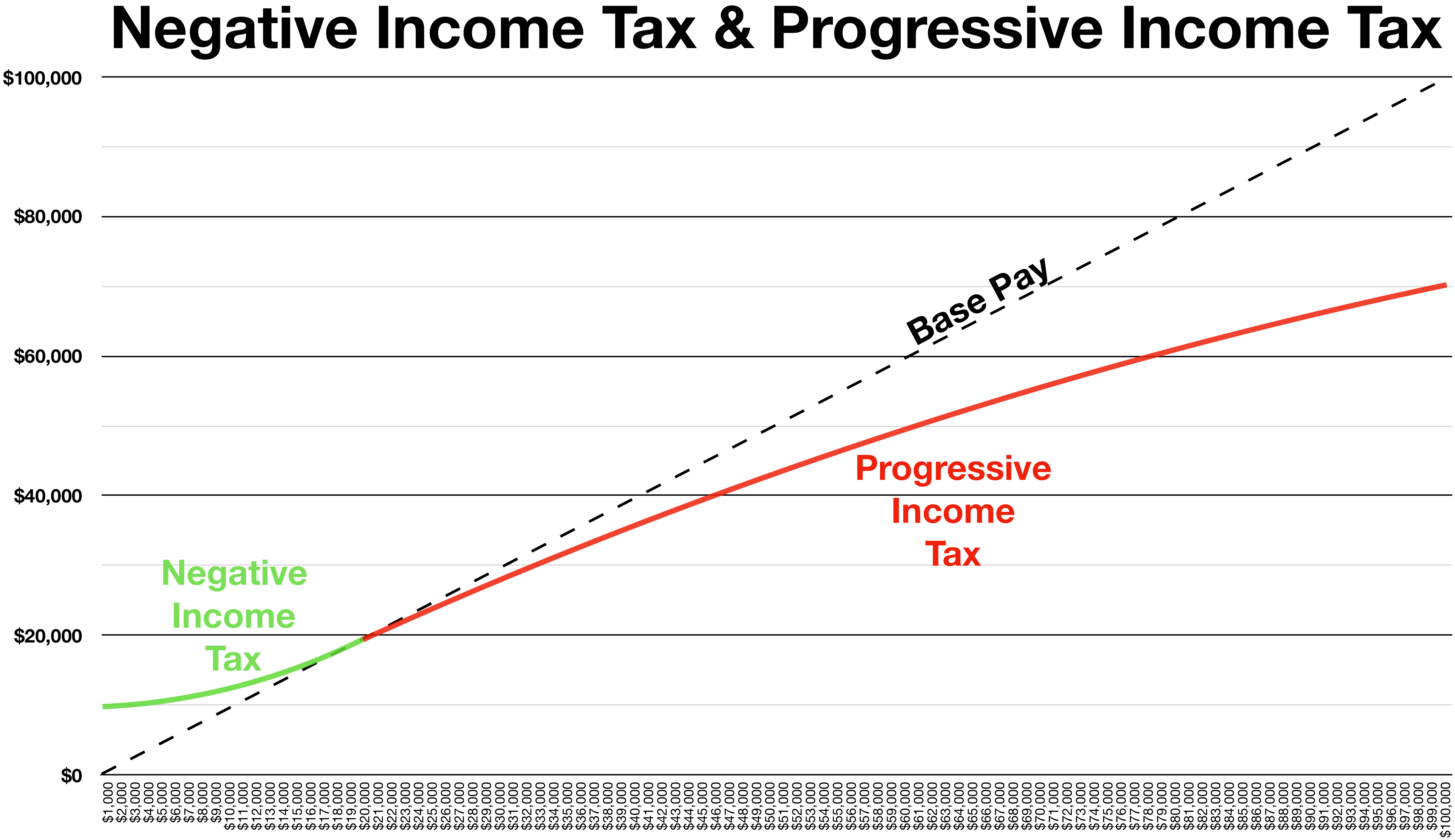

Germanys default interest withholding tax rate is 0. Progressive rates from 14-45. Over 95 tax treaties.

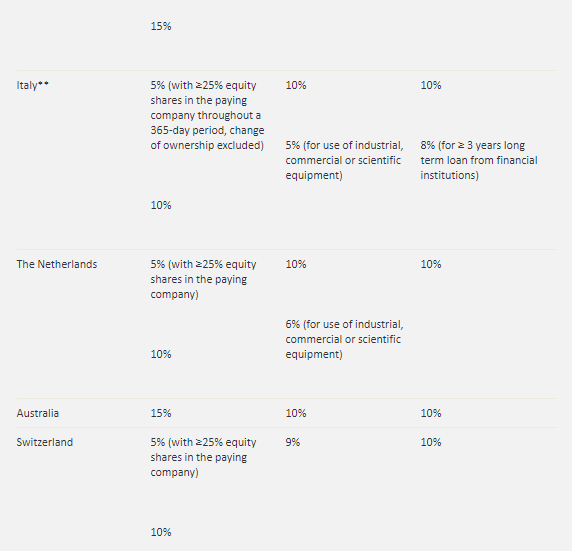

Summary of US tax treaty benefits. The rate is 15 unless the dividend is paid to a company holding at least 25 of the paid-up capital in the Dutch company. Treaty Rates for Interest.

Interest ccc Dividends Pensions and Annuities Income Code Number 1 6 7 15 Name Code Paid by US. In the case of European Union countries the EC. 0 0 0 Note that a rate of 49 applies in the case of interest and certain dividends where a Tax File Number is not quoted to the payer.

Tax Rates on Income Other Than Personal Service Income Under Chapter 3 Internal Revenue Code and Income Tax Treaties Rev. This table should not be relied on to determine whether a US. Individual Capital Gains Tax Rate.

The Protocol would continue to limit the withholding tax on dividends paid by a US. Corporate Capital Gains Tax Rate. The treaty permits a reduction of the 30 percent branch profits tax to 5 percent or lower on the dividend equivalent amount.

Corporate Income Tax Rate. Withholding Tax Rates 2022 includes information on statutory domestic rates that apply to payments from a source jurisdiction to nonresident companies without a permanent establishment in that source jurisdiction. Signed the OECD multilateral instrument MLI on July 7 2017.

In fact under a 2006 amendment to the US-Germany income tax treaty the governments of both countries are. German withholding tax at a rate of 15825 must be retained reported and paid to the Federal Central Tax Office by the licensee unless the licensor has received an exemption certificate based. I 5 if the dividends received are subject to a profits tax in the other state of at least 55 on the dividend or ii 75 if the profits tax is less than 55.

In this latter case the WHT rate will be reduced to. The tax authorities can order a WHT of 15825 including solidarity surcharge if ultimate collection of the tax due is in doubt. A treaty may stipulate a higher rate.

Other Tax Rates 2 Non-Resident Withholding Tax Rates for Treaty Countries 135 Country2 Interest3 Dividends4 Royalties5 Pensions Annuities6 France 10 515 010 25 Gabon 10 15 10 25 Germany 10 515 010 025 Greece 10 515 010 1525 Guyana 15 15 10 25 Hong Kong 10 515 10 25 Hungary 10 515 010 101525 Iceland 10 515 010 1525. If you have problems opening the pdf document or viewing pages download the latest version of Adobe Acrobat Reader. And second the treaty helps to promote residents of either country from avoiding taxes.

Non-resident corporations can apply to the Federal Central Tax Office for a 40 refund bringing the dividend withholding tax rate down to the CIT rate of 15 plus the solidarity surcharge resulting in an effective 15825 rate. The lower rates on dividends apply under certain conditions minimum shareholding specific shareholders in some cases minimum holding period. The reduced 5 withholding tax rate would not be available for RICs but the exemption from withholding tax on dividends described above would be available for dividends paid to a pension fund.

US persons making payments withholding agents to foreign persons generally must withhold 30 of payments such as dividends interest and royalties made to foreign persons. Both forms of tax are reduced by treaty relief. All persons withholding agents making US-source fixed determinable annual or periodical FDAP payments to foreign persons generally must report and withhold 30 of the gross US-source FDAP payments such as dividends interest royalties etc.

This treatment in the United States will assure that the benefit level the German reduction inures to the United States shareholders rather and to the United States Treasury The United States withholding rate with such dividend to German investors will send at 15 percent. Under US domestic tax laws a foreign person generally is subject to 30 US tax on a gross basis on certain types of US-source income. First to avoid double taxation of income earned by a citizen or resident of one country in the other country.

The Federal Republic of Germany will reduce its withholding rate on dividends paid to United States portfolio investors on a non-reciprocal basis from 15 percent to 10 percent. The German federal government in January 2021 adopted a draft bill to modernize the provisions for relief from withholding tax and the certification of capital gains tax. Obligors General Treaty.

Withholding Tax Rates To Non Residents Download Table

How To Calculate Foreigner S Income Tax In China China Admissions

Estate Tax Primer For German Investors In U S Real Estate Partnerships Dallas Business Income Tax Services

China Tax Treaties A Quick Guide To Withholding Tax Rates Of Royalty Dividend And Interest Lexology

Host Country Withholding Tax Rates On Cross Border Payments Of Download Table

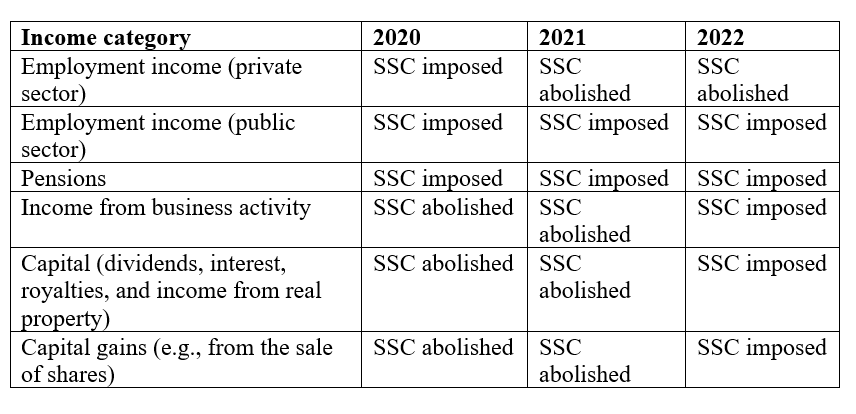

Status Of Russia S Initiative On Amending Its International Tax Treaties To Increase Withholding Tax Rate On Dividends And Interest To 15 Percent Deloitto China

2 Withholding Tax Rates On Royalties Paid To The United States Download Table

Greece Enacts Corporate Tax Rate Reduction Other Support Measures Mne Tax

China Tax Treaties A Quick Guide To Withholding Tax Rates Of Royalty Dividend And Interest Lexology

Why The United States Needs A 21 Minimum Tax On Corporate Foreign Earnings U S Department Of The Treasury

Tax Returns Tax Return Chart Powerpoint Word

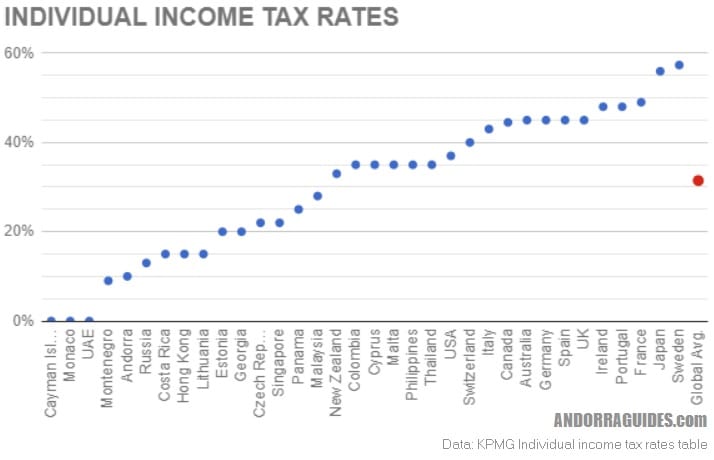

How Your Country S Tax Rate Compares To Us And The World Infographic

Estate Tax Primer For German Investors In U S Real Estate Partnerships Dallas Business Income Tax Services

Doing Business In The United States Federal Tax Issues Pwc