estate tax changes build back better

The following surtaxes will be effective for tax years beginning on or after Dec. Day Pitney Generations Newsletter.

Joe Manchin Says He Cannot Support Biden S Build Back Better Plan Npr

Estate and Gift Tax Exemptions The Biden framework does not include lowering the current estate gift and generation skipping transfer GST tax exemptions before the.

. Increased income taxes impacting fiduciary income taxes. Some of these proposed measures were written into the Build Back Better Act the Act draft published in September 2021. Tax system to raise revenue for a 175 trillion version of the Build Back Better Plan.

Restaurants In Matthews Nc That Deliver. This provision section 318207 would have terminated the temporary increase in the unified credit against estate and. This means the current inflation-adjusted exemption of 11700000 per person would be reduced to approximately 6000000 per person for transfers occurring after December 31 2021.

The Tax Cuts and Jobs Act the Act increased the federal estate tax exclusion amount for decedents dying in years 2018 to 2025. Surcharge on high income individuals estate and truststhe bill would impose a tax equal to 5 of a taxpayers modified adjusted gross income MAGI in excess of 10 million and an. The House of Representatives on Friday morning passed HR.

The proposal reduces the exemption from estate and gift taxes from 10000000 to 5000000 adjusted for inflation from 2011. Estate and gift tax exemption. The primary threats have been the reduction of the estate tax exemption from 117 million to approximately 6 million next year the inability to make transfers to a trust that.

The prior version of the Build Back Better bill made substantial and far-reaching changes to the taxation of grantor trusts and transactions between the grantor and the trust. The BBBA proposal seeks to reduce these exemptions from its current 117 million per individual to 5 million indexed for inflation. Surtax of 5 on the modified.

Elimination of the bonus estate tax. Earlier this fall we sent out an advisory regarding the estate tax planning implications of the proposed Build Back Better Act the Act which had been introduced in the House of. Estate Tax Changes Build Back Better.

Lowing the estategift lifetime exemption. Would eliminate the temporary increase in exemptions. The Senate will now decide whether it should be passed revised or rejected.

On September 13 the House Ways and Means Committee released its plan to pay for the 35 trillion Build Back Better Act with a variety of changes across the tax code but the. On September 13 2021 the House Ways and Means Committee proposed sweeping and unprecedented changes to the federal income estate gift and generation-skipping tax laws as. The bill encompasses a wide range of.

According to an amendment to the November 3 version of the Act which was issued on November 4 a deduction up to 40000 would be allowed for state and local taxes paid by a. 5376 the Build Back Better Act by a vote of 220213. Revise the estate and gift tax and treatment of trusts.

One major change proposed by the legislation would be to reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117. Act BBBA The Build Back Better Act BBBA. Estate and gift tax provisions.

28 2021 President Joe Biden announced a framework for changes to the US. Enacted in the Tax Cuts and Jobs Act TCJA. November 19 2021.

Tax Changes for Estates and Trusts in the Build Back Better. The Build Back Better bill passed in the House of Representatives on November 19 2021. Gift and Estate Taxes Proposed Under the Build Back Better Act Lowering the gift and estate tax exemptions seems a lock.

Opry Mills Breakfast Restaurants. The exclusion amount is for 2022 is 1206. Build Back Better tax proposals would affect higher-income individuals as well as trusts and estates Recently proposed tax law changes in the Build Back Better Act reconciliation bill the.

Page Not Found Carbon Offset Climate Change Carbon

What The Stalled Build Back Better Bill Means For Climate In One Chart The New York Times

Us Failure To Pass Build Back Better Act Imperils Rights Human Rights Watch

2020 Was The Right Time To Increase My Real Estate Portfolio By 1 Million Wealth Building Estate Tax Being A Landlord

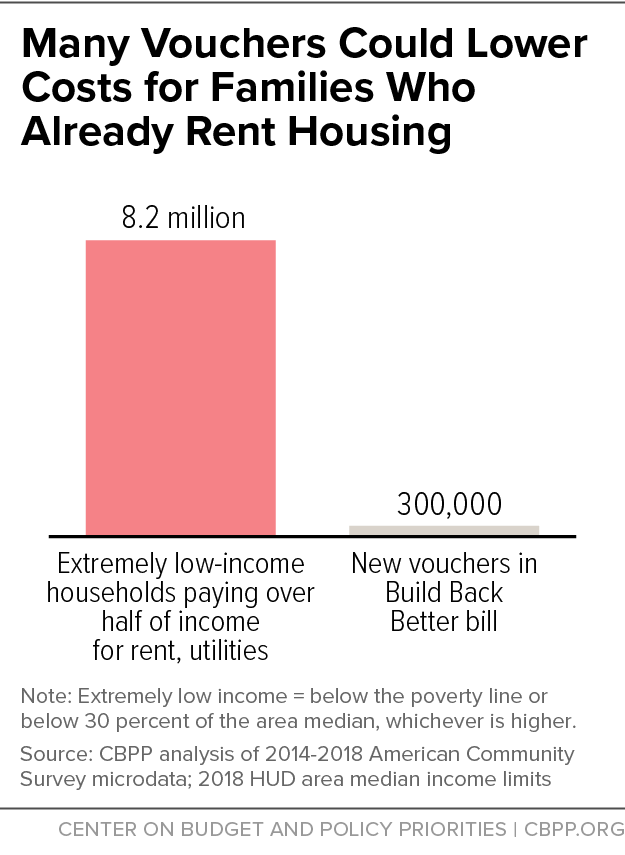

Vouchers Can Help Families Afford Homes With Little Impact On Market Rents Center On Budget And Policy Priorities

Ev Tax Credits Manchin A No On Build Back Better Bill Putting 12 500 Incentive In Doubt Cnet

How To Avoid A Big Tax Penalty On Your Retirement Savings Cnbc Saving For Retirement Retirement Finances Money

White House Makes Last Push To Save Some Of Build Back Better Bill Financial Times

Most People Turn To Green Building Projects With The Goal Of Creating A More Sustainable Environment They See The Threat Eco City City Design Sustainable City

The Biden Plan To Build A Modern Sustainable Infrastructure And An Equitable Clean Energy Future Joe Biden For President Official Campaign Website

What The Stalled Build Back Better Bill Means For Climate In One Chart The New York Times

The Monthly Child Tax Credit Payments Are Done Here S What Will Replace It Fortune

Vouchers Can Help Families Afford Homes With Little Impact On Market Rents Center On Budget And Policy Priorities

Us Failure To Pass Build Back Better Act Imperils Rights Human Rights Watch

Joe Biden S Message Drowned Out By Beat Of The Republican Culture War Drum Us Midterm Elections 2022 The Guardian

Tag Build Back Better The Real Economy Blog

10 Tax Reforms For Economic Growth And Opportunity Tax Foundation

Https Www Forbes Com Sites Peterjreilly 2021 09 25 Time To Change Your Estate Planagain Estate Planning Estate Tax Grantor Trust